Why Fleet Management Matters More Than Ever

For operators in transport, mining, agriculture, and construction, fleet management is far more than a line item on the balance sheet. Vehicles and heavy machinery are the lifeblood of day-to-day operations, and decisions about when to acquire, replace, or maintain assets can ripple across profitability, safety, and compliance.

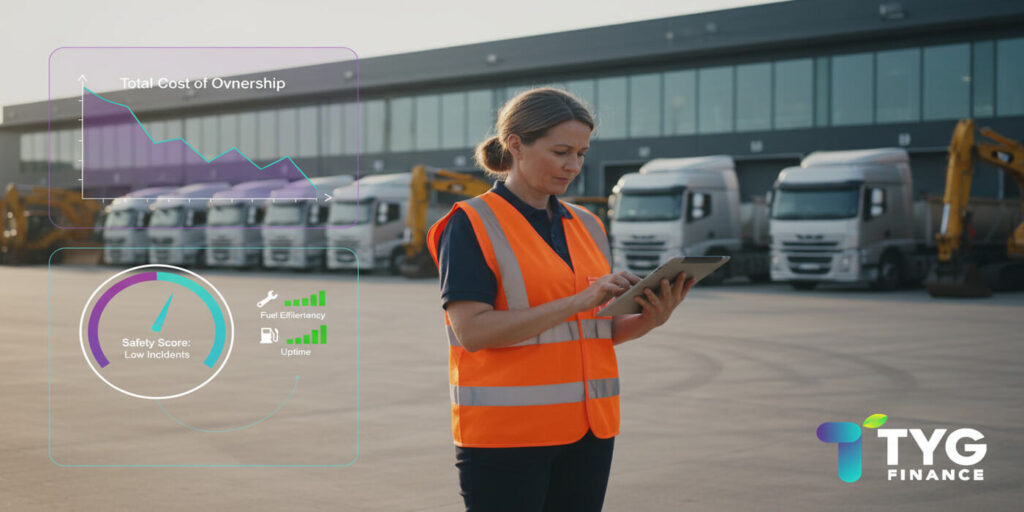

Yet one of the most pressing challenges remains striking the right balance between total cost of ownership (TCO) and driver and operator safety. Sticker price alone rarely tells the full story. Lifecycle costs, maintenance schedules, and the human factor of safety initiatives all influence whether a fleet strategy delivers long-term value.

This guide explores approaches that asset-backed businesses often consider when planning fleet replacements, evaluating cost efficiency, and prioritising safety.

Understanding Total Cost of Ownership (TCO)

When considering new vehicles or equipment, many businesses instinctively focus on the upfront purchase price. However, TCO offers a more holistic view by capturing the full lifecycle cost of an asset.

TCO often includes:

- Initial purchase price or lease cost

- Financing expenses

- Maintenance and repairs over the asset’s life

- Fuel or energy costs

- Insurance premiums

- Depreciation and resale value

- Downtime and productivity impact

For example, a vehicle with a higher sticker price but superior fuel efficiency and lower maintenance requirements could deliver greater savings across its useful life than a cheaper alternative. Additionally, following a proactive schedule for maintenance and repairs over the asset’s life is crucial for managing TCO effectively.

Learn more about financing options through our Business Vehicle Finance solutions.

The TCO approach is particularly vital in seasonal industries like agriculture, where operators must explore financing options for specific agricultural needs to ensure harvest-readiness.

Fleet Replacement Planning: Timing Is Everything

Deciding when to replace vehicles or machinery is central to efficient fleet management. Waiting too long may result in escalating repair bills, unpredictable downtime, and reduced safety performance. Replacing too early can tie up capital unnecessarily.

Operators often weigh:

- Duty cycles: How intensively vehicles are used in daily operations. High-demand fleets often require shorter replacement cycles.

- Resale market conditions: Timing replacement when resale values are favourable can offset new purchase costs.

- Maintenance cost curves: As vehicles age, maintenance costs rise steeply. Monitoring this curve helps avoid overspending.

- Compliance requirements: Newer fleets may align better with evolving transport safety standards and emissions regulations.

Well-structured replacement planning may support both cost efficiency and enhanced safety outcomes.

Safety as an ROI Consideration

As we’ve previously discussed in the context of seasonal safety pressures, for many fleet managers, safety isn’t just a compliance checkbox – it’s a strategic factor influencing financial outcomes. Reduced incidents can mean fewer downtime disruptions, lower insurance premiums, and higher employee retention.

Driver safety initiatives might include:

- Telematics and in-vehicle monitoring systems

- Defensive driving and fatigue-management training

- Ergonomic upgrades to cabins and seating

- Advanced driver assistance systems (ADAS) in newer vehicles

While safety measures involve upfront costs, they may yield a measurable return in the form of reduced accident rates and improved operational continuity.

TCO vs. Sticker Price: A Practical Comparison

| Factor | Cheaper Upfront Vehicle | Higher-Priced Vehicle |

|---|---|---|

| Initial Cost | Lower | Higher |

| Maintenance Needs | Higher over time | Lower due to reliability |

| Fuel Efficiency | Moderate | Higher |

| Safety Technology | Limited | Advanced (e.g. ADAS) |

| Resale Value | Lower | Higher |

| Long-Term TCO | Often higher | Often lower |

This comparison illustrates why many operators adopt TCO analysis instead of relying solely on purchase price when making financing decisions.

Financing as a Strategic Lever

Fleet management decisions often intersect with financing. Efficient financing solutions may help businesses align asset costs with cash flow, freeing capital for other investments while ensuring fleets stay modern and safe.

Two approaches that operators commonly explore:

- Fleet Finance – Consolidates multiple vehicles or equipment under one tailored facility, streamlining repayments and administration to better manage quarterly financial pressures. Explore our Fleet Finance solutions.

- Business Vehicle Finance – For single or smaller acquisitions, providing flexible repayment terms aligned with operational cycles.

By working with a finance partner that understands asset-backed businesses, operators can often secure facilities that match their growth trajectory.

The Role of Data in Fleet Efficiency

Modern fleet management is increasingly data-driven. Telematics, GPS tracking, and fleet management software can provide insights into fuel efficiency, driver behaviour, and maintenance forecasting.

Data-led decisions may help to:

- Identify underperforming assets

- Optimise replacement timing

- Improve route planning for transport fleets

- Track compliance with safety standards

Operators using data effectively often find themselves better positioned to balance both efficiency and safety considerations.

Regulatory and Industry Standards to Watch

Asset-heavy industries are subject to evolving rules around safety, emissions, and operational compliance. A few key references include:

- Australian Transport Safety Bureau (ATSB) – insights into safety investigations and recommendations.

- National Transport Commission (NTC) – guidance on heavy vehicle safety, compliance, and regulatory updates.

- ATO guidelines on asset depreciation schedules for business fleets.

Staying aligned with these standards can influence both safety outcomes and financial planning.

Practical Steps Operators Often Consider

- Conduct a TCO assessment for each vehicle type in the fleet.

- Create a fleet replacement schedule linked to duty cycles and safety benchmarks.

- Invest in driver safety initiatives as part of ROI calculations.

- Explore flexible financing solutions to smooth out capital expenditure.

- Benchmark against industry safety standards and compliance requirements.

Efficiency, Safety, and Strategic Finance Go Hand in Hand

Efficient fleet management is not about chasing the lowest price – it’s about finding the balance between total cost of ownership, operational safety, and financial flexibility.

For asset-backed businesses in industries like transport, mining, agriculture, and construction, these considerations can have lasting impacts on both profitability and resilience.

If your business is exploring its next fleet upgrade, it may help to consider financing strategies that align with your operational and safety priorities.